Many media pundits have declared that TV is dying. Their argument: Netflix, YouTube, HBO Go and other Internet-TV services mean that traditional channels, cable and satellite TV, will soon fade to black. Why pay for a lot of channels you don't watch? The CRTC, fearing the worst, agreed and held a two-week long public hearing on the future of TV this fall.

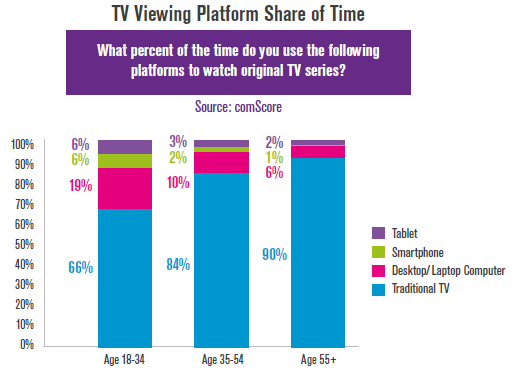

The demise of TV has been predicted since the invention of the VCR. There has even been some good research that points in this direction, including recent survey data from comScore showing that young adults in the U.S. spend about one-third of their TV time on tablets, smartphones or computers.

CRTC released data (which comes from CBC, although the Commission has not acknowledged the source) showing that about

one in three English Canadians now subscribe to Netflix. Despite this, CRTC has chosen to ignore Netflix, ever since the company refused to confirm the CBC research numbers. In a fit of pique, the Commission redacted the testimony of Netflix from the public hearing, the hearing on how Netflix will affect the future of TV. CMRI informed the Commission the CBC research probably exaggerated Netflix subscription but the CRTC ignored that too.

CRTC also released CBC data claiming

two out of three Canadians watch YouTube. (Neither CRTC nor CBC will reveal what questions were asked in the survey, normally a prerequisite in survey research.) YouTube's testimony was also

excised from the public record of that hearing but before the CRTC zapped it, we noted that YouTube boasted that one-billion people spend six-billion hours monthly watching YouTube videos. Like the CRTC data, that sounds impressive and even the

media critic of the New York Times touted the YouTube numbers. Putting aside the fact that these numbers are generated by YouTube's server software, which tends to exaggerate usage and measures computers not people, are they really that extraordinary?

No. Fact is that Canadians alone spend about four-billion hours watching traditional TV per month, while Americans spend almost 40-billion hours and worldwide, according to Eurodata and ITU, time spent watching traditional TV easily surpasses 500-billion hours per month! YouTube, which has been around for almost a decade, is a drop in the TV ratings bucket, rounding error in the ratings. YouTube is the everyman's cable community channel, a good training ground for future talent.

The pundits and the columnists ignore this because writing about the death of TV, rather than its health is more eye-catching. Also, some TV columnists seem to dislike TV, especially Canadian TV, and are writing for a medium that is truly on the ledge, newspapers. Incidentally, comScore, an independent measurement service, puts YouTube's worldwide usage at less than three-billion hours per month (September, 2014).

Third-party research estimates that Netflix's worldwide audience is even smaller, about one-billion hours per month.

Truth is that we are spending almost as much time as we ever did with TV programs delivered over-the-air or via cable/satellite. The TV Bureau of Canada confirms this with its

weekly viewing tracking service. And why wouldn't we? TV today is markedly better quality in technical and programming terms.

Take TV programming today. HBO, The Movie Network, Superchannel, TSN, Sportsnet, Discovery, Space, A&E, Showcase and many other specialty channels have schedules filled with compelling programs that are superior to those of pre-Internet times. CNN, CBC News Network and other news channels transport the viewer to any event or disaster in the world within minutes of it happening. The older, established channels, including CTV, CBC, Global, and the U.S. networks have addictive reality series, dramas that resemble Hollywood movies and comedy that makes pre-Internet TV seem quaint.

Also, the TV set has undergone a revolution. Today's HDTV flat screen sets provide almost a cinema-like picture and prices for HD sets have plummeted. 4K HD sets are already under $1,000, having fallen in price by 80 per cent in the last two years. Even smartphones and tablets have dramatically improved screen quality, making mobile watching viable. All the channels mentioned above and many others now offer their entire schedule in HD, which can be accompanied by surround sound, equal to the best stereo system. We are in the golden age of TV and Facebook, YouTube, Yahoo and Google don't stand a chance of replacing TV (unless they get into the real TV business).

In the past year or two viewing of traditional channels has fallen off minimally, about one hour per week. Services such as Apple TV and Netflix, the latter consisting primarily of older TV programs and movies, with video-on-demand offerings are eating ever so slightly into traditional viewing. But VOD has always played a relatively minor role in our TV viewing. Most viewing,

over 90 per cent, is live.

But some people want to watch recent movies on Apple TV or last season's TV series on Netflix because it is cheap and convenient. So, yes, there is some additional audience fragmentation linked to Internet-TV services but it continues to be small potatoes and only significant when it consists of the same types of programming found on legacy services.

The legacy cable and satellite TV companies provide one very valuable service: they collate hundreds of channels, which in turn consist of thousands of programs. The very best (and, true, some of the worst) Hollywood content, news, sports and international programming is brought together in one stream and is available at the touch of a remote control. Cable TV is a killer app.

So long as cable and satellite companies continue to perform this key role, they will maintain a large market share. They might not grow their share but that is difficult when you already have 90 per cent. However, here and elsewhere they are under pressure to adapt or justify their '2 for 1' pricing, even though this is a strategy used by most retailers.

The pundits complain that people only watch a dozen or so channels of the many they pay for. That may be true in a typical week but over the course of a month or year, even the CRTC might be surprised how many channels are used by the average subscriber.

No question, a small minority of people will search for replacements for cable; but given the cost of program rights, only a company like Netflix, with an international footprint, can compete with cable. Most people will keep the cable killer app and simply add Netflix or other premium Internet streaming services to their viewing menu. Proof: The Movie Network/Movie Central, Netflix's main competition, have lost only a few thousand of their

two-million-plus subscribers since Canadian launch of Netflix in 2010. Likewise, a few thousand homes of the more than 11-million who subscribe to cable/satellite have cut the cord entirely, according to

industry data.

Since the dawn of the Internet there has been an endless stream of articles claiming that it would result in the imminent demise of TV, not to mention the death of radio, newspapers, magazines and the post office. The decline of newspapers and magazines and a reduction in snail mail are real and undoubtedly caused by the Internet. The Internet has affected almost everything that deals with the printed word.

But TV has been little affected.

There is one noteworthy feature about the new TV services like Netflix, Apple TV and HBO's proposed Internet service that all TV networks and advertisers should heed: they are mostly commercial-free. Viewers have always disliked TV ads, especially in Canada, where the media economy is too small to create sufficient fresh ad copy.

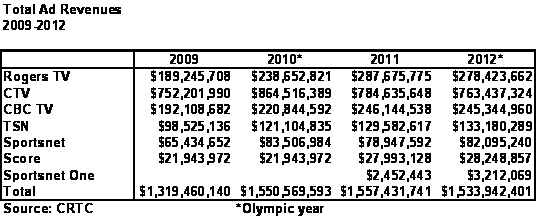

Canadians are subjected to the most cluttered, repetitive TV advertising environment in the world. It is the single biggest complaint we have about TV but the CRTC, CBC and other broadcasters ignore it and instead of reducing advertising, they approve more minutes per hour. CBC's news channel now airs over 100,000 ads per year to generate less than $100 per ad, about what you pay for a classified ad in a local paper. CBC's main channel, having lost rights to NHL hockey, is on course to see its ad revenue cut by two-thirds and ad revenue will then cover less than 20 per cent of expenses, less if you count the expense of the sales department.

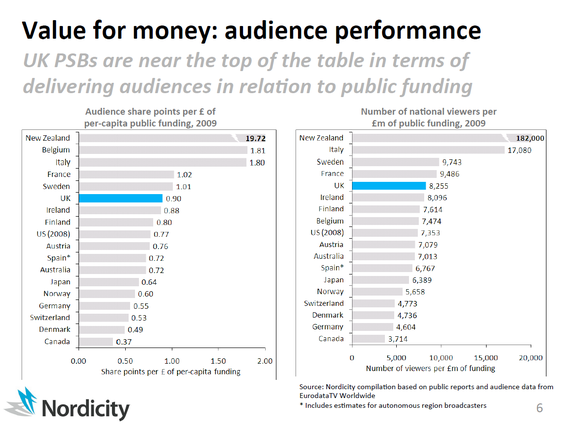

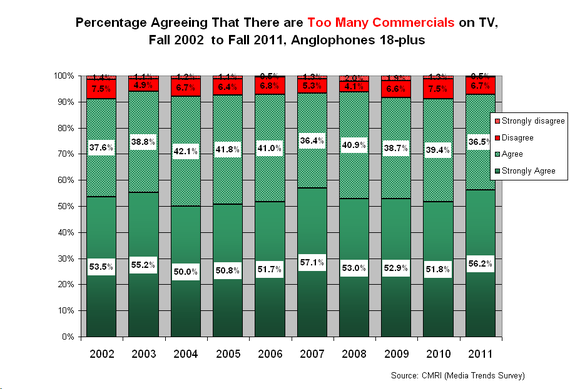

Elsewhere France has banned ads on its most important channel and most countries never allowed them on the main channels in the first place. If the BBC were to air one ad, it would be terminated. It doesn't even run ads in the Olympics. Not surprisingly, our research shows over 90% of Canadians agree there are too many commercials on TV; over half strongly agree.

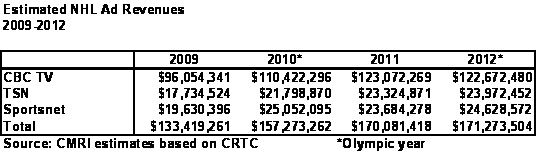

Too much of a good thing destroys the appetite. Despite maintaining audiences, TV ad revenue is not increasing. This TV season Rogers is learning the hard way by flooding the airwaves with NHL hockey and are failing to attract both the audiences and advertisers they hoped for,

as predicted. The new Rogers sales manager has already

departed, just weeks into the season.

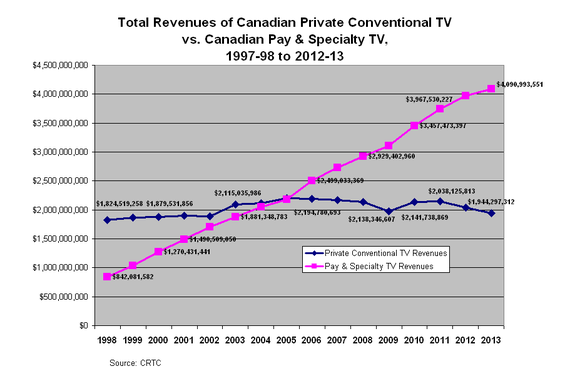

TV networks worldwide are facing stalled ad revenues and the growth in TV is coming from premium, subscription channels that have less or no advertising.

Canadians have reached their ad limit and are "

not going to take it anymore." The real question people are starting to ask: why pay for a lot of channels with so many commercials? CBC, which is now mostly funded by taxpayers, and any other network with a business model that can eliminate or at least reduce ads, can flourish in this new environment. That is, by giving viewers what they really want, programs, not commercials.