Netflix and Apple TV (second version) launched in Canada

Apple has been very low key in its marketing of Apple TV and only those who have purchased an iPad have likely ever been approached to mate their iPad with the Apple TV gadget. It is about the size of a hockey puck and provides on demand access to the latest Hollywood movies and TV programs and offers a vast library of older movies, TV shows, podcasts and sports. Apple TV also allows one to wirelessly “throw” music or video from an iPhone, iPod or iPad to your TV and surround sound system, so that one doesn’t have to walk around with ear buds or dock their iPod to a small player with poor sound. The small Apple TV device is remarkably easy to hook up to your TV and has one hidden advantage over cable and satellite: there is no HST on any content you order.

Netflix on the other hand has been very aggressive and advertised extensively and today about 1 in 12 Canadians report that they are subscribers to Netflix. Netflix offers on demand access to a large library of older movies and TV shows and some exclusive programming and costs only $8/month. Various devices allow one to access Netflix, including some Blu-ray players. Ironically, I access Netflix through my Apple TV gadget.

CMRI's Media Trends Survey for the first time this year asked Canadians what they thought of the new ‘channel’, Netflix. Netflix has found a sweet spot with middle aged adults as shown in the first chart. The channel also skews toward women. Who better to target than women aged 35-54 who are too busy at home with the kids and at work to go out to the movies?

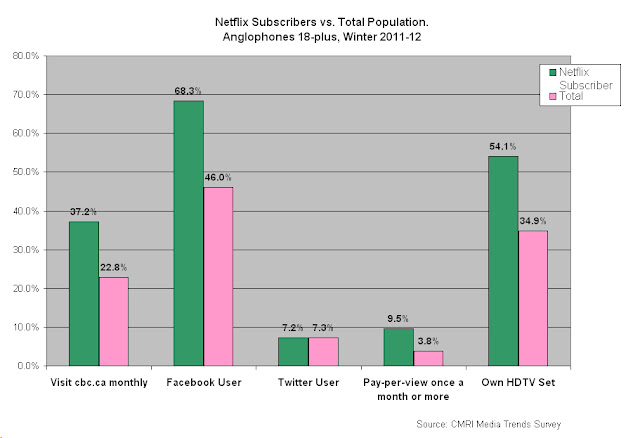

What else do we know about Netflix subscribers? Well, we know they are much more likely to own an HDTV set; over 50% have an HD set, which means they use a lot of bandwidth to watch movies in HD. They are also much more likely to use Facebook, visit the CBC’s web site and almost three times more likely to order a pay-per-view movie once a month or more from their cable/satellite company. So, these Netflix subs do not appear to be canceling their cable any time soon. However, they are too busy to use Twitter, being just like the average person when it comes to tweeting.

Netflix subs are also heavily into mobile media. Almost all have a cell phone and many have smartphones. The great majority text message and large proportions send photos, surf the net and download music or video with their mobile device, eclipsing the average person in the population on all these measures.

Netflix subs are, naturally, much heavier users of the internet but listen to slightly less radio than average and watch about the same amount of TV. The latter finding runs counter to research sponsored by the CBC. The CBC research employs an impressive number of respondents and adheres to many good principles of survey research but is it slanted by internal politics? For example, would CBC’s surveys ask which network is best at various categories of programming and report the results? You can purchase all the CBC survey results for about $25,000, a bargain given that the CBC pays something like $400-500,000 each year to undertake the surveys.

When we asked Canadians which network had the best movies, Netflix finished second only to TMN/Movie Central among Netflix subs, a notable marketing feat given the limited time the channel has been available to Canadians. Showcase also fared well among Netflix respondents but not a single Netflix sub in our survey said the CBC had the best movies, despite CBC's continued reliance on Hollywood movies in the summer and over the Christmas holidays.

The 2011 survey results are from CMRI's Media Trends Survey conducted November-December 2011 among a representative national sample of approximately 900 Anglophone respondents aged 18-plus. Margin of error +/-3.3%. The Media Trends Survey has been conducted for ten consecutive years and has surveyed over 15,000 Canadians in total in this period. It is the only survey to have measured media use and attitudes continuously over this decade. The Media Trends Survey is not sponsored by any one industry or affiliated with a media company. Therefore, the surveys are scrupulously designed not to bias respondents into favouring one medium or media outlet over another.

No comments:

Post a Comment